Winning your lawsuit feels great, but that only gets you halfway through the battle of getting paid. Soon you’ll be asking yourself, “How can I collect my judgment?” because the court will not collect your judgment debt for you for you. It’s up to you to figure out how to collect your money.

Your first step is to research what income or assets the judgment debtor has that could be used to pay your judgment. Even if you work with a judgment recovery specialist, the first question they will want answered is if the debtor has some income or some assets or if the debtor is likely to have collectible assets in the future. In order to collect your judgment the debtor needs to have something to collect from.

We Pay Cash for Judgments.

We buy California judgments. Get a no-obligation cash offer now!

Get StartedTable of Contents

- How do you collect a judgment?

- How do I collect my judgment?

- How do I collect when I win a lawsuit?

- We Pay Cash for Judgments.

- How do I collect my labor board judgment?

- What judgment collection services are available?

- Is there an agency that pays you today collects your judgment later?

- How can I select a judgment collection agency?

- How much does a Judgment Collection Agency Charge?

- How do I work with a judgment collection agency or service?

- How difficult is it to collect a judgment?

- How do I Find judgment collectors?

- Where can I find help collecting a judgment?

How do you collect a judgment?

Self-Help

First, try some self-help options. California Court’s self-help section lists Tips for Collecting your Judgment on their website. Familiarize yourself with the options available to you when trying to collect your judgment. It includes advice on researching the debtor’s income and assets, garnishing wages, and collecting from the debtor’s property like bank accounts and real estate.

It is important to be organized with your records and keep copies of all documents, actions, contact information and expenses.

Collection Agencies

If you have exhausted the self-help methods, you might consider a Collection Agency. Should you decide to go with a collection agency, you’ll want to confirm that they’re above board in their business practices and tactics before you hire them. For example, most reputable collection agencies will be members of their industry trade group.

In general, creditors (or agents of the creditor) can contact the debtors by phone, text or email but only between certain hours of the day to request debt settlement. On the messages, they must clearly identify themselves as debt collectors, plus give a notice that clearly states what the debtor owes. There are strict requirements on how this notice should be given. So be sure to work with a collection agency that follows these rules.

How do I collect my judgment?

Collecting your judgment can be the most difficult part of your case. The court does not collect the money for you, however the court can help you to collect your money. The first thing you need is a final judgment. It is imperative that you are organized in this process to have a higher chance of collecting. If you miss deadlines, your judgment can become invalid. You’ll want to be familiar with all the ways you can Collect your Judgment.

Of course, the easiest way is if the debtor pays you voluntarily. If your debtor wants to be responsible and pay his debt but cannot pay a lump sum outright, you can work out flexible payment terms with the debtor and you can accept installment payments. Be careful that you do not create a contract that replaces the judgment.

If the debtor does not want to pay you voluntarily, which is most common, then you will need to get information about the debtor’s assets that can be used to satisfy the judgment. Here is where the courts give you a tool to use in the collection process. You can request a debtor’s examination. This is where the debtor is ordered to appear before a court under oath to answer questions about their assets. There are strict legal procedures to follow in this method and unfortunately it is common for debtors to fail to show up to these examinations. Unfortunately a Debtor’s Examination can end up being a waste of time for you.

Sell Us Your Court Judgment

We buy California court judgments so you don't have to do judgment enforcement.

If you do discover that the debtor has assets that can be used to satisfy the judgment, then you can follow the legal steps to collect your judgment from those assets. Below are several methods that you can try. You can even try several of these methods at once.

- Collect from Wages (Wage Garnishment)

- Collect from Bank Account or Safe Deposit Box

- Put a Lien on Real Property

- Put a Lien on Personal Property

- Get a Writ of Execution

If debtors are unable to pay their debts because they are insolvent or do not have the assets to collect, lawyers call this judgment proof. Other debtors who do not want to pay can do a great job of hiding assets and have gone to the extent of transferring their assets to become judgment proof.

However, even if your debtor is unwilling to pay, you still have options to collect your judgment, such as:

- A Bank levy

- Wage Garnishment

- A Till Tap

- Seizing Personal Property

- Real Estate Lien

Seizing money from the debtor’s bank account is known as a bank levy. You need to have details of the debtor’s bank account, account name and the name of the bank for a successful cash transfer. Taking a percentage of the debtor’s wages to collect your judgment is a wage garnishment. A till tap is against a business cash register. A real estate lien might get you paid if the judgment debtor sells or refinances their property, if there is enough equity in the property and it does not qualify for exemptions.

How do I collect when I win a lawsuit?

Here are a few key tips that will help you with the collection process:

- Ask. First step is to ask, by writing a Demand Letter. Keep it simple and state the facts only. Remind them that each day they do not pay the judgment accumulates interest. Additionally, the debtor should know that non-payment will negatively affect their credit score.

- Be Persistent. People may be reluctant to pay a debt even after a court order. You can always use the court to help you recover your money. As mentioned above there are several methods to try. If one is unsuccessful, try another.

- When everything fails. If you have exhausted all methods and it seems that your judgment debtor is judgment proof, be sure that you renew your judgment if its about to expire. Your judgment debtor’s fortunes could turn within the next 10 years and you will continue to have the right to collect your judgment for as long as the judgment is valid.

- Hire a Judgment Professional. You can find a judgment collection professional who may be able to offer you a cash payment immediately for your judgment.

We Pay Cash for Judgments.

We buy California judgments. Get a no-obligation cash offer now!

Get Started

How do I collect my labor board judgment?

You filed a wage claim with the Division of Labor Standards Enforcement, the claim was investigated by the labor board, reviewed by an administrator, and then a hearing was held to determine the outcome of your case. If I win a labor board award, the labor commissioner will file my award as a court judgment if the business does not pay the wage claim.

So, how do I collect my labor board judgment? The Labor Commissioner’s judgment enforcement unit will offer to collect your judgment. In general, this is not a great option, because they likely will not put adequate resources on judgment enforcement. They will require that you assign your judgment to them which will prohibit your ability to collect your judgment yourself.

If the business that owes you money has shuttered its doors, you may be out of luck. If the business is open or additional judgment debtors are named, then there is still a chance that you can collect on your judgment. At this point you may want to find a judgment recovery professional who has experience in Wage Claims.

What judgment collection services are available?

There are several types of judgment collection agencies. Each type of judgment collector will specialize in different types of judgments and enforcement methods. Some judgment collectors specialize in family law cases, others in labor board awards or small claims suits. Different judgment collectors favor different enforcement methods. Some prefer to levy and sell real estate, some garnish wages, others focus on finding bank accounts.

Understand your financial relationship before hiring a collection agency. They will receive a percentage of the amount collected and you will likely have to wait until they collect on the judgment before you see any money.

Is there an agency that pays you today collects your judgment later?

The good news is YES, there are agencies who can pay you cash for your judgment. If you are tired of trying to collect the judgment yourself, look for judgment professionals who are willing to buy your judgment for an up-front fixed fee.

Months or years might go by with no payment from the debtor. Creditors will ask themselves, ‘Who can help me collect my judgment?’

It is up to the judgment creditor to figure out how he or she will collect their judgment. Collecting can be even more challenging than winning!

Using judgment collectors can be an easy way collect your small claim lawsuit. But how do you choose your collecting agency?

Some collection agencies will pay you first then collect your judgment. Others will first collect your judgment then pay you as the money comes in. Compare offers from different judgment collectors and find one that fits your needs.

The fixed fee will be lower than the amount owed to you, but the huge benefit is that you get paid before the judgment collector has recovered even part of the judgment. Judgment recovery professionals are good at what they do, but they will not always recover on every judgment they buy. So, they take a financial risk when buying a judgment, therefore they will need offer discounted buyouts.

Sell Us Your Court Judgment

We buy California court judgments so you don't have to do judgment enforcement.

How can I select a judgment collection agency?

Consider both their fee and their recovery rate

Judgment collectors offer to buy your court judgment at less than its full amount because they need to cover their costs of doing business. They have enforcement costs, filing fees, possible attorney’s fees, and they take the financial risk of collecting nothing at all.

Taking that into account, is the amount that the judgment collector offers you reasonable? How quickly do you need to see some money? Consider these factors before choosing your judgment collector.

Agencies will keep a percentage of the total amount that they are able to collect. So, when choosing your judgment collection agency look at the percentage they keep and their recovery rate.

A judgment collection agency with a high recovery and percentage charged is better than one with a low debt recovery rate and low percentage charged.

From the below example, if you were to choose between judgment collectors A and B, B would be the better choice because they help you recover more money.

| Agency A | Agency B | |

| Percentage charged | 12% | 40% |

| Recovery Rate | 7% | 25% |

| Amount recovered out of 50k | $3500 | $12500 |

| Cash Returned to the business |

$3080 | $7500 |

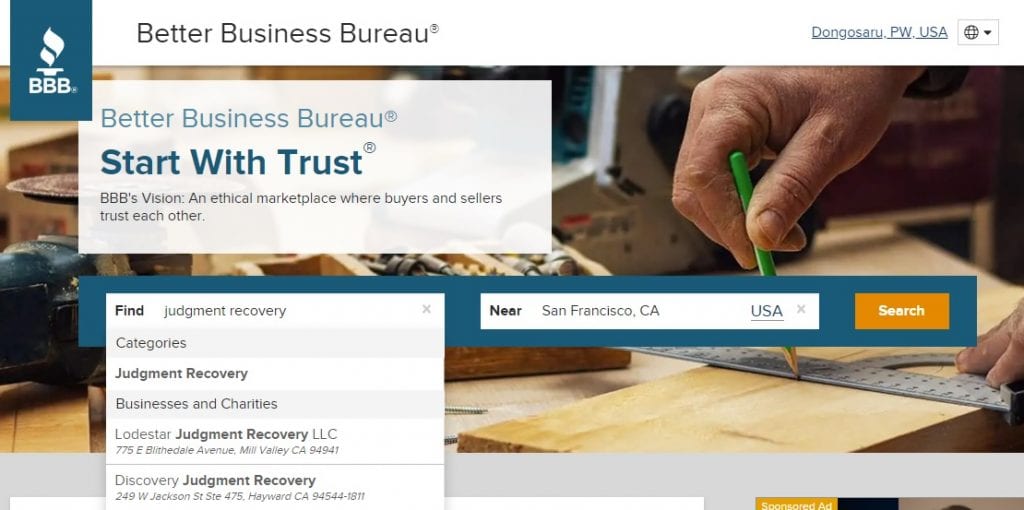

Get a look at their collection history

Important information can come from those who have previously purchased a businesses’ products or used their services. Therefore, it is important to make sure to ask for referrals from businesses or individuals who have successfully worked with the judgment collectors in the past.

Judgment collectors are experts at debt recovery, and they are there to help you recover your judgment. You can get good information about collection agencies and judgment professionals from:

- The Better Business Bureau (BBB)

- Trade Associations and Licensing Boards

- The Chamber of Commerce

- Social Media, including Yelp and Reddit

Check for Licensing

May debt collecting agencies are required to have a license to practice as stated under the collection agency laws. At the very least an agency should have appropriate business licensing, if required by law.

How much does a Judgment Collection Agency Charge?

Judgment collection agencies’ fees depend on a variety of factors related to the judgment and their professional business practices. Be sure you fully understand the financial arrangement and offer before accepting it.

California judgments are valid for ten years. The period to collect your judgment starts running from the entry date of the judgment. It is important to remember that you can legally renew your California judgment for an additional 10 years if you properly renew with the courts. If your judgment has expired, it is invalid and no longer enforceable.

The judgment collection process can become easier when you get professional enforcement help. Here are ways in which judgment collection agents can charge for their services:

Contingency Basis

When a judgment collection agency does not pay unless they collect on your judgment, the agency is working on a contingency basis. The advantage to this method is the client never pays anything out of pocket. But the disadvantage is that it can take a long time to see any money, if ever.

Fixed-price Basis

Some judgment collectors choose to pay a fixed price for a judgment up-front with no waiting time. The money paid to the judgment creditor is immediate. The advantage to the creditor is that they get money in their pocket right away, with no waiting period.

Variable Costs

When a judgment collecting agency uses both fixed-price and contingency fee structure, they are operating on variable costs structure.

Judgment collection agencies often choose to tier their payment rates by size. Even small judgments require a certain level of effort to earn a certain amount, regardless of the amount. This means that smaller judgments have lower payment rates. Check out the below example to help you understand this concept better. Know that each agency will have different payment percentages and fees.

| Based on size | Payment in % |

| Under $1,000 | 10% |

| $1,000 – $5,000 | 15% |

| $5,000 -$50,000 | 20% |

| $50,000 -$500,000 | 30% |

| over $500,000 | 50% |

Payment for a judgment claim also is dependent on whether the debtor has assets that can be used to recover the debt.

We Pay Cash for Judgments.

We buy California judgments. Get a no-obligation cash offer now!

Get StartedHow do I work with a judgment collection agency or service?

Collecting your judgment can be made easy by working with judgment collection agencies. Even though you do not recover the full amount of your judgment, using a judgment collection professional can be of great help in getting you some money right away.

Working with a judgment collection service is easy. After you select an agency, they will mail you one or two short documents to assign the judgment to them for collection. That’s it! You should expect occasional updates from them, and with some luck, eventually a check.

You might also work with a judgment buyer who pays you cash up front. Judgment buyers will send you very similar documents to assign your judgment to them. The best part is that they will also include a check!

Plan Your Strategy

Every judgment gives the losing party a chance to appeal. Therefore, most judgment buyers will not buy a judgment until the last day of filling the appeal has passed. During this waiting period you might not want to begin enforcing your judgment because you might encourage the party who lost to file an appeal.

Get to Know the Debtors Assets

After losing a lawsuit, the debtor can do many things so that you do not collect his assets. He may proceed to declare bankruptcy or try to transfer some of his assets.

To stay ahead of the game, you should immediately put a lien the debtor’s property. You can do this by recording an Abstract of Judgment in the recorder’s office in the county where the debtor owns property. Once recorded, the debtor cannot transfer his properties to another party without paying the lien.

Educate yourself

It is important to know what you are doing during the collection stage. Read through your state’s court website for very helpful information on Tips for Collecting Your Judgment. Learn everything you need to know about wage garnishments, property liens, and bank levies and more

Consider Hiring a Professional

There are many agencies that are available and can help you collect your judgment in exchange for a percentage of what they collect on the judgment. Take your time to select the best agency that fits your needs. If you do not have the time to collect your judgment, or if you are overwhelmed with the whole process, a collection agency can be a good solution. After all, it is better to collect some of the money than none of it.

Sell Us Your Court Judgment

We buy California court judgments so you don't have to do judgment enforcement.

How difficult is it to collect a judgment?

Collecting the judgment can be the most difficult and challenging part of the case. You can do it yourself, hire a collection agency or hire a judgment buyer. Most collection services will take a percentage of the debt only if they can recover the money. Most judgment buyers will buy the judgment at a discount, but pay you immediately. Know that the process of judgment collection can be long, frustrating and time consuming for the judgment creditor.

As seen above, winning in the court is not the end of the road. Collecting your judgment can be difficult. Here are things that make collection of a judgment difficult.

- Debtor declares bankruptcy.

- Debtor refuses to pay.

- Debtor hides assets.

- Debtor has no assets that can be used to pay for the judgment.

- Debtor is protected within a business entity (i.e., LLC or Corp).

How do I Find judgment collectors?

Some judgment collection agencies specialize in specific industries and can help you recover your debt more easily depending on their expertise. Do your research and ask lots of questions.

It is important to take time to look for a reputable debt collection agency. Some agencies have been around for a long time and have positive reviews, while others fall below ethical guidelines and laws. Be sure to work with only reputable professionals.

Before choosing your judgment collection professional, ask yourself the below question to find a good match.

- Does the debt collection agent specialize in my industry?

- Is the judgment collection agency certified by any industry groups?

- Can the debt collection agency tailor their services to suit my need?

- What is the reputation of the agency?

- Will the judgment professional pay me up-front?

- What is the success rate of debt collection?

- Is the agent transparent in the efforts to collect your debt?

- Is the agency asking me to pay up-front fees?

We Pay Cash for Judgments.

We buy California judgments. Get a no-obligation cash offer now!

Get StartedWhere can I find help collecting a judgment?

Attorney, Collection Agency, Judgment Buyer, or you

After winning your lawsuit, you can hire an attorney, a judgment collection agency, a judgment buyer, or you can try to collect your judgment yourself. Your choice depends on your preference and needs.

- Hire an attorney. If the judgment creditor can pay an attorney to help them with judgment collection, that is always an option. The upfront costs are higher than other options, but an attorney will likely be dedicated to the case.

- A judgment collection agency will try to enforce your judgment at no cost you and will pay you only if they can collect. The benefit is that there are no upfront costs, but it could take a long time to receive any money, if at all.

- A judgment buyer will pay you cash up-front immediately for your judgment if certain criteria are met related to the judgment. Your offer will be less than the judgment amount, but the benefit is that you get immediate payment.

- You can choose to enforce your judgment yourself using self-help methods available to you. You’ll keep everything you collect. But judgment enforcement can be time consuming, confusing, and frustrating for the judgment creditor.

The easiest and quickest way to collect your judgment is to work with a judgment buyer. This option is the only way to receive immediate up-front cash selling your judgment.