Winning a court judgment is just the first step in obtaining damages from your debtor. Judgment enforcement is the next critical step. After the court has entered a judgment, the losing party is supposed to pay, but often the debtor doesn’t pay. So, what is the process of enforcing judgments?

Enforcing court judgment can be a difficult process especially if the debtor does not voluntarily pay your judgment. In such a case, you need to look for ways to enforce the judgment.

Table of Contents

- How do I enforce a court judgment?

- What is judgment enforcement?

- What does it mean to enforce a judgment?

- How do I enforce my Judgment?

- How do I find a judgment enforcement agency/service?

- Is it hard to enforce a judgment?

- Who can help me enforce my judgment?

- How do I enforce a labor board judgment?

- How do I enforce a labor board award?

How do I enforce a court judgment?

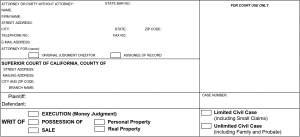

Most court judgment enforcement is though filing documents. The court clerk will check that you have properly completed the documents. But they can not give you legal advice. After the court has processed your filings you may need to serve copies on the judgment debtor, their employer, or their bank. For example, a writ of execution is delivered to the sheriff who will personally serve the document per your instructions. The sheriff then sends a return of service to the creditor and it is filed with the court. If the debtor objects, a hearing may be set. During the hearing, the judge will either uphold the garnishment and pay you, or will allow the debtor a claim of exemption. If the debtor fails to show up in court, you will likely prevail.

What is judgment enforcement?

After you have sued your debtor and won, the court may award you a money judgment or order. If the judgment debtor fails to pay the amount ordered by the court, the judgment creditor will have to apply Enforcement of Judgment Law to enforce the judgment. The court will not automatically enforce the judgment. It is up to the judgment creditor to follow the enforcement process.

What does it mean to enforce a judgment?

A judgment is a ruling by the court law in a lawsuit. A final judgment resolves the issues between the two parties (judgment creditor and judgment debtor) and clearly states the obligations of each party in the lawsuit. For Example, in a civil case, the judge may find the defendant liable and thus award money to the plaintiff. On the other hand, the judge may also find the defendant not liable and therefore not award anything. The need for judgment enforcement arises when a judgment or order issued by the court is not paid. Although some people comply with a court judgment, others ignore the judgment and refuse to settle what they owe. When a judgment creditor refuses to pay a judgment, enforcement is required to make the debtor pay up their debt. When a creditor wants to enforce a judgment, he will need to go back to court if the judgment debtor refuses to pay. The judgment creditor has several options for enforcing court judgment depending on the monetary damages. For some judgments, the judgment creditor can garnish the judgment debtor’s wages, levy a bank account, or even have a lien placed on their property.

We Pay Cash for Judgments.

We buy California judgments. Get a no-obligation cash offer now!

Get StartedEnforcement of judgment California

After a judgment creditor obtains a judgment, judgment collection is the responsibility of the creditor. Therefore, the judgment creditor has to look for ways to collect the debt themselves using California Enforcement of Judgment Laws. The courts provide many documents for the judgment creditor that will help them with judgment collection.

Things to do before Enforcing Judgment

Before beginning the process of judgment enforcement, you need to do the bellow things.

Locate the Judgment Debtor

Before the efforts of collecting your judgment, you need to locate your judgment debtor. This should be done as soon as you enter your judgment. However, as time passes, it could be difficult to locate a judgment debtor. There are many excellent people search tools on the Internet and most offer a lot of information for free.

Determine the Debtors Assets

An order of examination also known as a debtor’s examination can be a valuable tool in learning about your debtor. This is a court proceeding where the debtor is brought in and questioned about their income and property for the sake of judgment collection. Additionally, you can subpoena third parties for information, such as their mortgage lender or bank.

Calculate the Amount Owed

Before enforcing court judgment you need to know exactly what your judgment debtor owes you. The amount on the judgment is rarely the final amount paid by the debtor unless they pay the judgment in full promptly.

The judgment creditor is entitled to reimbursement of any costs the judgment creditor incurs during judgment collection, such as issuing a writ of execution. Additionally, judgments that are not paid accrue 10% interest per year.

How do I enforce my Judgment?

If a judgment debtor has refused to pay the judgment then the enforcement process begins. There are many methods that can be used to collect a judgment. Below are common judgment enforcement methods you can use to collect your judgment.

Collect from Wages

If a judgment debtor is employed, his or her income can be garnished up to 25% until the judgment is paid in full.

Collect Money from the Debtors Bank (Bank Levy)

If the judgment debtor has an account or a safe deposit box, you can collect your judgment from their account or seize the contents of the safe deposit box.

Place a lien on Real Property

You can place a lien on the judgment debtor’s property with an abstract of judgment. In case the debtor tries to sell or refinance their real property, the judgment creditor will be paid the judgment in full plus the accrued interest. In some cases, you can ‘foreclose’ the judgment lien and force the sale of the debtor’s property.

Place a lien on Personal Property

A judgment creditor can place a lien on personal property two ways: File a Notice of Judgment Lien (Form JL1) with the California Secretary of State; and, personally serve an Order of Examination (OEX) on the debtor. The JL1 lien expires after five years and the OEX expires after one year. If you uncover personal property you can instruct the sheriff to levy and sell any personal property you uncover. ‘Personal property’ is anything valuable that can be sold for cash, for example: jewelry, automobiles, electronic devices, musical instruments, etc.

Place a lien on a lawsuit a debtor has against someone else

If the debtor has sued someone and is hoping to recover some money, you can place a lien on the money the debtor hopes to collect when he or she wins the lawsuit. This is accomplished by filing a Notice of Lien (Form EJ-185) in the lawsuit.

Don't Collect Your Judgment.

We are California judgments buyers. Get a no-obligation cash offer now!

https://californiajudgments.com/get-in-touch-2/How do I find a judgment enforcement agency/service?

Many companies claim to help you enforce your judgment successfully. But, how do you find the best? Here are some methods you can use to find judgment enforcement agency.

Referrals

Asking your attorney, financial advisor, friends, or family is one of the best ways to find your judgment enforcement agency. You can never go wrong with this method. You’re sure to work with a company that provides excellent services.

Internet

Most judgment agencies that are ready and willing to work with you can be found on the Internet. For example, on Google, a search for ‘judgment enforcement agency California’ will provide you many leads. Check out the screenshot below.

How will you choose the best judgment agency on the internet? Their website is a good indicator of the type of service you can expect. Is it professional and up to date? Or, is it sloppy and old? Also, check for reviews left by customers who have used their services. Always consider working with a company that has positive reviews.

Is it hard to enforce a judgment?

Enforcing court judgment is not as easy as it sounds. You need to exactly know the legal process to enforce your judgment successfully. Sometimes, debtors may be stubborn and unwilling to pay what they owe you. When you do it the wrong way, your debtor may be able to transfer or hide his assets to avoid paying you.

A good first step is to contact your judgment debtor with a formal letter or invoice. This will be the first attempt to enforce your judgment. You should be polite and don’t threaten the debtor or attempt to harass them.

Secondly, make arrangements to carry out a debtor’s examination to exactly know the assets that your debtor has. This is done through the court.

If your debtor cannot afford to settle the entire judgment, you can consider settling for a lesser amount. Though you’ll get paid less, it will reduce the collection cost and time.

The Legal Collection Process

To start the collection process and get paid, you obtain a Writ of Execution from the court. File the writ of execution in the clerk’s office to have it issued. Here, you’re required to fill proper forms for the process.

Take your writ of execution to the sheriff and ask for a seizure assets form. Here, however, You must know the details of the assets you need to be seized. For garnishment, you need to know which bank your employer uses.

In case your attempts to enforce your judgment fails, consider hiring an expert.

Sell Us Your Court Judgment

We buy California court judgments so you don't have to do judgment enforcement.

Who can help me enforce my judgment?

Judgment enforcement agencies will always be available to help you collect your judgment from your creditor when they have refused to pay. They can either collect the judgment for you or buy your judgment, depending on the value of the judgment and the debtor’s circumstances.

The collection agency will choose recovery methods like garnishing wages, levying bank accounts, or placing a lien on the debtor’s property. For you to enforce a judgment, make sure to look for a reliable judgment collection agency to do it for you.

How do I enforce a labor board judgment?

The law requires an employer to pay his or her employers accurately and promptly. California has many minimum requirements that employers should pay their employees. The employer can not pay less than what is mandated by law. If your employer owes you money and refuses to pay, there are methods to fix the situation that may result in obtaining a labor board judgment.

Speak with your Employer

If you have unpaid wages or salary, make sure you speak to your employer as soon as you notice it. This could be due to a payroll issue and can be corrected in time. Make sure you give your employer enough time to rectify the problem before seeking legal measures.

It is important to be sure about what your employer owes you before taking any legal help.

File a Wage Claim with the Labor Commissioner’s Office

You have the right to file a wage claim when your employer doesn’t pay wages or benefits owed. A wage claim starts the process to collect on those unpaid wages or benefits. If your wage claim is successful, the Labor Commissioner will file it as a court judgment against your employer. You can then enforce your labor board judgment in the same way as any other judgment.

We Pay Cash for Judgments.

We buy California judgments. Get a no-obligation cash offer now!

Get StartedHow do I enforce a labor board award?

If your employer owes you wages and has refused to pay you, you can seek help from the California Labor Board. First, the labor board will review your claim and conduct an investigation. Then it will hold a hearing for the final determination of your claim case. After you are awarded your judgment, the California Labor Board will automatically enter your judgment against your former employer in the civil court system.

When awarded a judgment, you can attempt to collect the judgment yourself or assign it to the Division of Labor Standards Enforcement (DLSE). Assigning your judgment to the DLSE for collection is free. But you get what you paid for: nothing. Collecting your judgment yourself or with the help of a judgment collection professional is better.

You could also take a copy of your judgment to a qualified attorney in recovering labor board judgments. Your attorney will then review your judgment and later advice you on the best methods to use when collecting your judgment.

Collect from your Employer

If you were paid by check, review one of them to get your employers bank details. With these details, you can your employer’s bank account. First, obtain a writ of execution from the court clerk. Then deliver the writ to the Sheriff with instructions to levy your employer’s bank account.

You can also ask the court awarding you the judgment to direct the sheriff to do a “till tap” or put a “keeper” in the debtor’s business. In a “till tap” he sheriff will go to the business and take enough money out of the cash register to pay your judgment. In a “keeper” the sheriff will remain in the judgment debtor’s business and take all the funds that come in until the judgment is paid.

Also, you could have the court issue an “Abstract of Judgment” to place a lien on your employer’s real property. This will prevent your employer from selling his or her property without first paying you.

Are you looking for ways to enforce your judgment that your debtor has refused to pay?

Enforcing court judgment is not a simple process. In most cases, it is advisable to use a qualified judgment enforcement agency to ease the process of recovering what the debtor owes you. Or you can reach out to a third party to sell your judgment. Most importantly, follow the legal process when enforcing your judgment.

Don't Collect Your Judgment.

We are California judgments buyers. Get a no-obligation cash offer now!

https://californiajudgments.com/get-in-touch-2/