Congratulations! You have spent your money, time, and energy to win your court judgment. The judgment orders the debtor to pay you. But how or when will your debtor pay?

After a creditor finally gets a judgment against a debtor in the court of law, they feel like they have won. But creditors soon come to realize that collecting your judgment is a whole separate process. So they may be thinking, “What if I could sell my judgment for cash?”.

Table of Contents

- Why would you sell your California judgment?

- Can I sell my judgment for cash?

- I want to sell my judgment, but am I allowed to?

- How much can I sell a judgment for?

- How do I sell my judgment for cash?

- Where can I sell a judgment?

- How do I sell a court judgment?

- Is it possible to sell a labor board judgment?

- Selling a labor board award.

- How do I sell a judgment?

- How do I sell my judgment to a collection agency?

Why would you sell your California judgment?

The fact that you won the lawsuit against your debtor does not mean that you will be paid your debt. It is your responsibility as a judgment creditor to follow the legal process to force the debtor to pay your debt. You need to come up with a plan of how you will collect it yourself.

Collecting a judgment is not a simple process. It depends on the nature of the debtor’s assets, and, the judgment creditor may face a lot of challenges when collecting the judgment. Read here how to collect a judgment.

Selling a judgment in California

If you do not want to go through the hassle of collecting your judgment, you could sell it. But not all judgment collection agencies can be of help when you want to sell your judgment for cash. Some will give you a quick payment before they collect. But other collection agencies will only pay you after they’ve gone through the tedious process of collecting your judgment.

By selling your judgment to the right collection agency, you will receive immediate cash for your judgment. Some judgment collection agencies in California will help you with your judgment collection and some will pay you cash now. You only need to choose one that suits your needs.

We Pay Cash for Judgments.

We buy California judgments. Get a no-obligation cash offer now!

Get StartedCan I sell my judgment for cash?

You won your claim but haven’t been able to collect your judgment. Maybe you’ve even levied your debtor’s bank account, garnished their wages, or placed liens on their property, but still haven’t been able to make them pay your debt.

When your judgment is for lost income or damaged property delayed payments are sometimes especially difficult. You may not have the resources to wait for the judgment to be paid by the judgment debtor, and neither do most collection firms. But some firms do have resources to pay you cash today and to wait for the judgment to be paid.

However, there’s a catch. The judgment collection company does not pay for the full amount of the judgment. It only pays you a part of your judgment — sometimes only a small fraction of the judgment amount. The judgment collection company needs to make a margin between the price it pays you and how much it eventually collects from the debtor.

The amount that you can sell your judgment for cash depends on the age of the debt, the amount of the debt, and the financial status of the debtor. Compare offers from different companies to select the best place to sell your judgment. Moreover, you can use a quote from one company to leverage against another to get the best selling price.

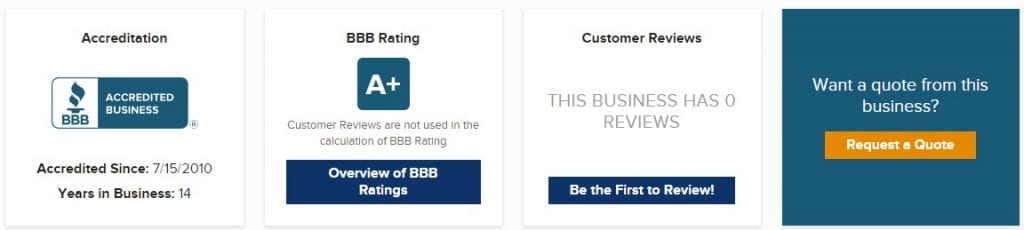

Additionally, look for a reputation for fair-dealing, colleague endorsements, and customer ratings to find a company that will buy your judgment fairly.

Don't Collect Your Judgment.

We are California judgments buyers. Get a no-obligation cash offer now!

https://californiajudgments.com/get-in-touch-2/I want to sell my judgment, but am I allowed to?

People may want to sell their judgment but wonder if it’s legal. The answer is yes! Any judgment can be sold just like any other personal property. This includes civil judgments, labor board judgments, divorce decree judgments, probate judgments, and bankruptcy court judgments. Any judgment can be sold.

When you sell your judgment, you are washing your hands of the entire lawsuit. The person you sell your judgment to steps into your shoes and is the new judgment creditor.

Anything the judgment buyer does after you sell your judgment is separate from you. They will bring all judgment enforcement actions in their name only. You will have no involvement in, or liability for, their actions. In fact, many judgment enforcers will include indemnification language in their purchase agreement.

If you want to avoid the legal pitfalls of collecting your judgment, go ahead and contact a judgment buyer. Sell your judgment for cash.

How much can I sell a judgment for?

Most judgment sellers expect to be paid more than what their judgments are worth. Though all judgments are different there are some rules of thumb you can apply to get a rough idea of the value of your judgment. Anyone who buys judgments for cash will look at the following factors to make you an offer.

If the debtor has no visible assets or cash in the bank then it may be impossible to collect your judgment regardless if you use judgment collection agents or not. Don’t expect a cash offer for your judgment.

If the debtor has a good job and no bankruptcies you may be able to sell your judgment for cash. But don’t expect to sell your judgment for more than a few pennies on the dollar. Your judgment is a better candidate for a collection agency who will pay you after they collect.

Why are most judgments worth pennies on the dollar?

Here are for frequent reasons why most judgments sell for pennies on the dollar.

- The debtor has declared bankruptcy.

- The debtor has no assets and poor employment history.

- The debtor has other judgments against him.

- Your judgment is a default judgment that could easily by vacated.

There is no guarantee that any judgment can be enforced. One thing you should know is that judgments are not cash, and they solely depend on the debtor’s assets worth.

How can you maximize the worth of your judgment?

Know your judgment debtor! Any information you have about your judgment debtor may increase the value of your judgment. Name(s), alias(es), address, age, social security number, employment, relatives — all are helpful. Make a list of any assets or businesses you think the debtor owns. The more the debtor’s assets, the more likely it is that judgment buyers would want to buy the judgment for cash.

Secondly, don’t underestimate how long it will take to get your debtor’s payment. It might be tomorrow, a year from now, 10 years from, or even never. Patience will maximize value. Although, choosing to work with a judgment collection agent will increase the chances of collecting your judgment sooner than you expect.

Sell Us Your Court Judgment

We buy California court judgments so you don't have to do judgment enforcement.

How do I sell my judgment for cash?

Selling your judgment for cash is the easiest way to recover your debt. The time and energy used to sue your debtor can be a waste of time even though you won the claim suit, and, the courts are of little help in recovering your debt.

So, what is the next step to take after winning your claim suit? It’s possible to sell a judgment for cash to a judgment collection agency.

Whether the judgment collection agency pays for the judgment on a contingency basis cash upfront the process of selling your judgment is quick and easy: The judgment buyer will overnight you two one-page documents to sign and return. If you are selling your judgment for cash, they will include a check. That’s all there is to selling your judgment! Sign your name twice and cash your check.

Where can I sell a judgment?

Though winning a judgment is a joyful moment, the process of getting what is yours can be tricky and tedious. This is the reason why there is an industry that has been built up around the concept of selling judgments.

Selling your judgment will get your money much faster than following the legal collection process. This is economically sound especially if you are in a financial crisis and need your cash almost immediately.

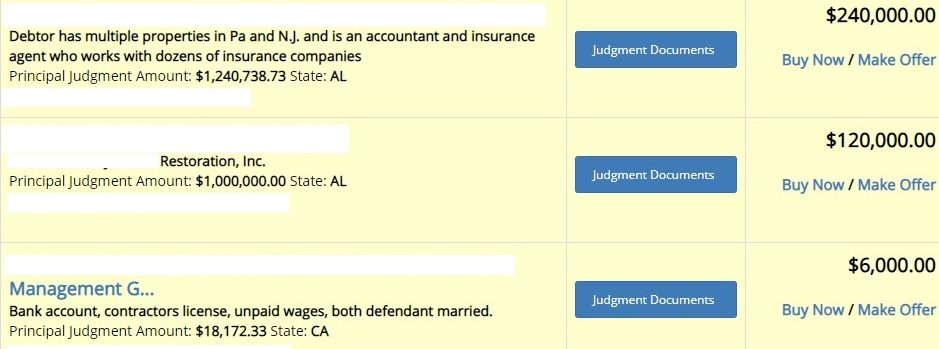

You can find many judgment collection agencies online that are ready to buy your judgment. You could also list your judgment on a judgment market place.

How do I sell a court judgment?

Selling a judgment is a process by itself. After the judgment creditor lists the judgment on a judgment marketplace, interested buyers will send their offers. Afterward, the seller reviews the letters of interest and chooses the most favorable. The chosen buyers are contacted and the negotiation process begins.

Since the parties purchasing judgment for cash want to buy it as cheap as possible, you’ll need to be tough and only accept offers you feel are fair for your judgment. If you show the buyers you are flexible, they may try to take advantage of you. Remember, they are in business to make money.

Once you have a deal with the chosen party, you will need to go to through the website’s purchase and sale process. They want their cut too.

Another option is to sell your judgment for cash to a judgment collection agency. This is a more informal negotiation that is less stressful. Though direct and clear communication you can often get more cash for your judgment.

Is it possible to sell a labor board judgment?

What if you have been awarded a labor board judgment, can it be recovered? This depends on the financial situation of your previous employer.

There are three situations that can make you not to collect your labor judgment.

- If your previous employer owed you money but they went out of business.

- If your employer has declared bankruptcy

- The labor board rarely makes the owners of the business liable for the judgment. It, therefore, becomes difficult for you to collect the judgment personally.

If you do not want to go through the tedious process of collecting your judgment, you can go ahead and sell it. This the only way you can recover your debt with no hassle. A judgment buyer will research your labor board judgment and make you a cash offer.

We Pay Cash for Judgments.

We buy California judgments. Get a no-obligation cash offer now!

Get StartedSelling a labor board award.

How do I sell a labor board award? If you have a labor board award the labor board will file it as a judgment with the appropriate Superior Court. Then the main factor in selling your labor board judgment is if your previous employer has declared bankruptcy. You can look for a judgment buyer to buy your judgment.

Labor judgments are filled at the civil court, regardless of size – not in the small claims court. In California, the Labor Board Code 1194.3 states, ‘an ex-employee can only recover the cost of an attorney and that used to enforce the judgment for the unpaid wages.’ However, this can only be against the named company and not the owners. If the business is out of business, then you are unlikely to collect.

If the court has awarded you with a labor board judgment, you can go also sell it to a judgment collection agent. You can ask for a reference from friends and relatives who have previously sold their judgment. If your employer has assets to pay you off, you will likely find a judgment collection agent willing to buy your judgment.

You can also make use of a judgment market place to find a buyer for your judgment. You just list your labor board judgment in the hope of getting an offer.

How do I sell a judgment?

There is no way you can force your creditor to pay you what they owe you. They will either do it willingly, or you will have to use some extra effort to make them pay you. Here, by ‘extra effort’ we are referring to taking the legal route to collect your judgment.

When you have finally made your decision of selling your judgment for cash, you need to look for a judgment collection agency that will buy at a fair price. Make sure to approach several companies so you can choose the one with the best offer.

When you have finally chosen the judgment collection agency to buy your judgment, make sure to have a contract that shows that both parties have agreed to the transaction. Also, make sure that you clearly understand the contents of the contract before you make a deal.

Tips for a Successful Sale

Always make sure to get more information about the judgment collection agency from the Better Business Bureau website. Here, you will get to see the rating and how they handled and resolved complaints from customers.

Companies will always need a copy of your judgment, copy of certain court documents, and your debtor’s personal information. The amount that a judgment collection will pay depends on the age of the judgment and other factors.

How do I sell my judgment to a collection agency?

You have finally won your claim suit against your debtor but do not want to go the process of collecting. You can use the help of judgment collection agency to help you collect your judgment. First, you need to sign over your judgment rights to a judgment buyer for the agreed amount.

Also, it is important that the agreed terms are written down and both parties to sign. You can now exchange the agreed amount with your judgment buyer.

Have you won a claim suit against your judgment and wondering how you can collect your judgment fast?

You can now go ahead and sell your judgment to recover your cash fast. With the above guide, you can now comfortably sell your judgment to the right judgment buyer comfortably. I hope your question ‘Can I sell my judgment?’ has been answered.

Don't Collect Your Judgment.

We are California judgments buyers. Get a no-obligation cash offer now!

https://californiajudgments.com/get-in-touch-2/